Higher Advance Rates

more reasons Why we are The best Factoring Company

For Your trucking Business...

more reasons why we are The best Factoring Company For Your trucking Business...

more reasons why we are The

best Factoring Company

For Your trucking Business...

No other factoring company matches our level of superior service and offerings.

You get more for your money. Industry average advance rates (the percent of the invoice face value you receive upfront) are 70-90%. So, for example, if your customer owes you $1,000, you ordinarily should expect an advance payment of $700 to $900. Our typical advance rates are higher than average - at 85-100% depending on industry and payment track record of your customers.

Honoring Your

Client Relationships

The fact that a factoring company will be communicating with your customers on your behalf is often overlooked. Our level of service, stability and longevity, and the caliber of our employees is second to none. We have been in business since 1979 and have staff who are dedicated to working in this industry as a career. Choose us not only for your sake but for the sake of your relationship with your customer too. Not only will you benefit from our extraordinary service and real-world know-how, but so will your customers.

Deep Resources

Another strength we have is our flexibility and ability to match your particular needs and industry to the perfect funding resource. Most other factoring companies have limitations for size, industry, and risk level of companies with whom they’ll factor. We can save you a tremendous amount of time by helping you find the best match for your business from the very beginning.

We have a vast network of industry colleagues that we’ve built in our nearly 40 years in the business. So you can rest assured we will help you find a solution.

No Minimum

Most factoring companies require you to factor every customer and every invoice, or they require you to factor at least a minimum monthly amount. With us, you decide which customers you want to factor, and even which invoices on any particular customer with no minimum requirements.

Our factoring agreement is like carrying a credit card in your pocket. You carry it to use when you need it but don’t sign an agreement which will force you into factoring when you don’t need it.

Transparent Fees

Most factoring companies are not upfront about their fees. We are different. We are totally transparent about our fees. When you apply, you are provided a transparent, no obligation rate proposal with the fee for your company. See which other factoring company, if any, will be totally up front with their fees before they try and get your business.

Financially Strong

We have been in business since 1979, are privately held, and have a proven track record of being financially strong. We have survived many economic downturns and in doing so, can help you through any difficult times you might encounter. We won’t go out of business when the times get tough, like some other factoring companies have regretfully done in the past.

Personalized Solutions

We are not beholden to Wall Street investor money. We are a privately held company and don’t answer to investors or boards. We are like-minded entrepreneurs who understand what it takes to run a business. We take the time to hear your story, learn your struggles, and put together a solution for you rather than relying on an algorithm to determine your company’s value. Who do you want to rely on as a cash flow partner to fund your business?

Dedicated Account Executives

Many factoring companies have either a lot of employee turnover, a complex voice mail system that you get lost in or operator call centers where you talk with a new representative every time you call. We offer a dedicated account executive to be your point of contact – someone who gets to know you and your business intimately, and who can immediately help you without wasting your time.

Our Business

is Your Business

We track your invoices like your own credit and collections department would, following up with friendly reminder calls and/or emails on your behalf if needed, until payment is received. Our business credit monitoring systems allow us to see early negative trends so that we can protect you from risky transactions.

We also estahlish a mutual risk tolerance to reduce the chance of putting you in the position of ever having to buy back an invoice in the first place.

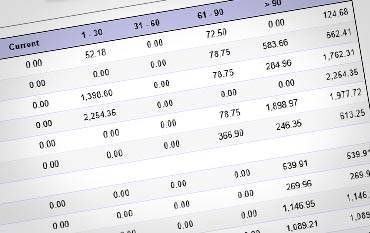

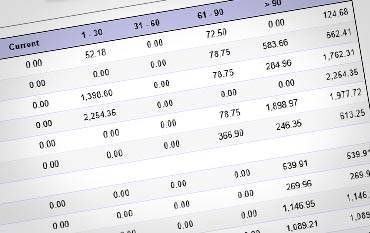

Payment Trend Alerts

Your dedicated account executive alerts you to any collection issues so there are no surprises. You also have 24/7 at-your-fingertips access to online aging reports.

Up-to-Date Customer

Credit History

You get direct online access to your customer’s credit, or you can call and speak with your account executive – your choice. Stay ahead of negative payment trends. Having easy access to current information is critical to running your business and filling your next order.

Leading Edge Technology

We make strides to incorporate the latest technology to expedite the funding process, such as electronic submission of invoices, online reports, online credit checking and other emerging methods to streamline the process and reduce overhead, which means lower rates and time-saving efficiencies for you. Most other companies don’t even come close.

Higher Advance Rates

You get more for your money. Industry average advance rates (the percent of the invoice face value you receive upfront) are 70-90%. So, for example, if your customer owes you $1,000, you ordinarily should expect an advance payment of $700 to $900. Our typical advance rates are higher than average - at 85-100% depending on industry and payment track record of your customers.

Honoring Your

Client Relationships

The fact that a factoring company will be communicating with your customers on your behalf is often overlooked. Our level of service, stability and longevity, and the caliber of our employees is second to none. We have been in business since 1979 and have staff who are dedicated to working in this industry as a career. Choose us not only for your sake but for the sake of your relationship with your customer too. Not only will you benefit from our extraordinary service and real-world know-how, but so will your customers.

Deep Resources

Another strength is our flexibility and ability to match your particular needs and industry to the perfect funding resource. Most other factoring companies have limitations for size, industry, and risk level of companies with whom they’ll factor. We can save you a tremendous amount of time by helping you find the best match for your business from the very beginning.

We have a vast network of industry colleagues that we’ve built in our nearly 40 years in the business. So you can rest assured we will help you find a solution.

No Minimum

Most factoring companies require you to factor every customer and every invoice, or they require you to factor at least a minimum monthly amount. With us, you decide which customers you want to factor, and even which invoices on any particular customer with no minimum requirements.

Our factoring agreement is like carrying a credit card in your pocket. You carry it to use when you need it but don’t sign an agreement which will force you into factoring when you don’t need it.

Transparent Fees

Most factoring companies are not upfront about their fees. We are different. We are totally transparent about our fees. When you apply, you are provided a transparent, no obligation rate proposal with the fee for your company. See which other factoring company, if any, will be totally up front with their fees before they try and get your business.

Financially Strong

We have been in business since 1979, are privately held, and have a proven track record of being financially strong. We have survived many economic downturns and in doing so, can help you through any difficult times you might encounter. We won’t go out of business when the times get tough, like some other factoring companies have regretfully done in the past.

Personalized Solutions

We are not beholden to Wall Street investor money. We are a privately held company and don’t answer to investors or boards. We are like-minded entrepreneurs who understand what it takes to run a business. We take the time to hear your story, learn your struggles, and put together a solution for you rather than relying on an algorithm to determine your company’s value. Who do you want to rely on as a cash flow partner to fund your business?

Dedicated Account Executives

Many factoring companies have either a lot of employee turnover, a complex voice mail system that you get lost in or operator call centers where you talk with a new representative every time you call. We offer a dedicated account executive to be your point of contact – someone who gets to know you and your business intimately, and who can immediately help you without wasting your time.

Our Business is Your Business

We track your invoices like your own credit and collections department would, following up with friendly reminder calls and/or emails on your behalf if needed, until payment is received. Our business credit monitoring systems allow us to see early negative trends so that we can protect you from risky transactions.

We also establish a mutual risk tolerance to reduce the chance of putting you in the position of ever having to buy back an invoice in the first place.

Payment Trend Alerts

Your dedicated account executive alerts you to any collection issues so there are no surprises. You also have 24/7 at-your-fingertips access to online aging reports.

Up-to-Date Customer Credit History

You get direct online access to your customer’s credit, or you can call and speak with your account executive – your choice. Stay ahead of negative payment trends. Having easy access to current information is critical to running your business and filling your next order.

Leading Edge Technology

We make strides to incorporate the latest technology to expedite the funding process, such as electronic submission of invoices, online reports, online credit checking and other emerging methods to streamline the process and reduce overhead, which means lower rates and time-saving efficiencies for you. Most other companies don’t even come close.